SBI Shinsei Bank launched its real estate non-recourse finance business in 2000 when Japan's real estate securitization market was in its infancy. Since then, we have granted about 1,700 real estate non-recourse loans in the cumulative value of approximately 6.2 trillion yen (*note 1). The real estate non-recourse finance business has grown to become one of the core businesses of SBI Shinsei Bank.

We also provide real estate non-recourse finance with a focus on sustainability and ESG/SDGs perspectives(*note 2).

(*note 1) As of the end of June 2023.

(*note 2) As a part of our "Shinsei Green Finance Framework" formulated in May 2020, we provide financing known as "Shinsei Green Loans" limited to projects that demonstrate a clear environmental improvement effect.

What is a real estate non-recourse loan?

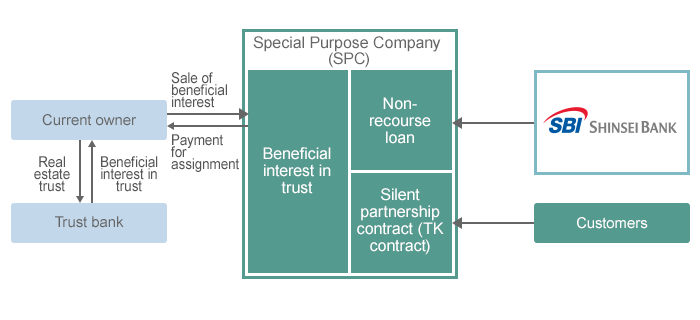

A real estate non-recourse loan is a loan secured only by specific real property and is repaid using cash flows (rent income and proceeds from the sale of the property) generated from that collateral property. Even if the borrower fails to perform its debt obligation, the creditor's recovery is limited to the collateral. It generally uses the following structure.

When do you use a real estate non-recourse loan?

- A real estate non-recourse loan is used to satisfy the following customer needs.

- Review the real properties owned for financial strategy

- Change the policy from the ownership to use of real properties (sales and lease-back transactions)

- Acquire real properties for investment purpose

What are its advantages?

- Improve fundraising and financial indicators through the liquidation of assets owned

- Improve investment efficiency through the leverage effect

What can SBI Shinsei Bank do?

Our experience, track record and know-how in the real estate non-recourse finance business are top-class in Japan's financial industry. Our expert staff members with detailed knowledge in finance and real estate provide solutions that match customer needs by proposing the optimum structure and giving legal, accounting, and taxation advice.

What properties can you grant a loan for?

A real estate non-recourse loan can be provided for properties such as offices, residential properties, commercial facilities and premises, hotels, physical distribution facilities, industrial facilities, and healthcare facilities. While we generally grant a loan to a property that is already in operation, we will also consider providing a loan to the development and construction of these properties. A loan can also be granted to a number of properties.

What assessments do you perform?

After hearing the needs of our customer, we conduct our own property assessment to check the location, income and expenditure situation, title, physical conditions, compliance and other issues concerning the property. Based on the valuation we arrive at, we present the terms and conditions including the amount of loan we can offer.

What are the terms and conditions of a loan?

- Loan amount: The minimum loan amount is approximately 1 billion yen, but it can be negotiated.

- Period: The loan period is generally three to five years, although there is room for negotiation.

- Interest rate: There is no uniform standard. We set the interest rate depending on transaction details.

- Security: We create the security right on the target property (including beneficial interest in real properties).

- Guarantee: Not necessary.

- Other: Other conditions generally include covenants on the income and expenditure situation of a property and other benchmarks.

Products and Services

- Corporate Loans

- Loan Syndication

- Loan Arrangement

- Finance for Start-up

- Real Estate Non-Recourse Finance

- Project Finance

- Renewable Energy Finance

- Acquisition Finance

- Ship Finance

- Healthcare Finance

- Sustainable Finance/Impact Finance

Solutions